Vital Advair:

Vital Advair: Fresh Daily Market Intelligence

Sign up now

Sign up now

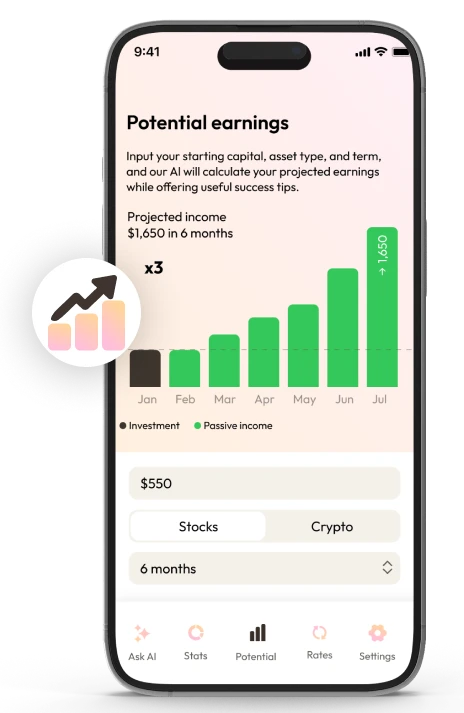

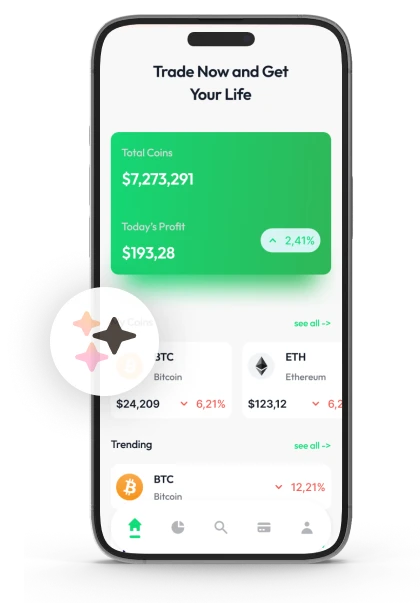

Imagine seeing the market’s pulse in real time. Vital Advair watches every price shift through multiple analytical layers, pinpointing actions that truly influence direction. It doesn’t drown you in constant motion, it highlights the moments that matter: rapid expansions, hesitation, or turning points that signal change.

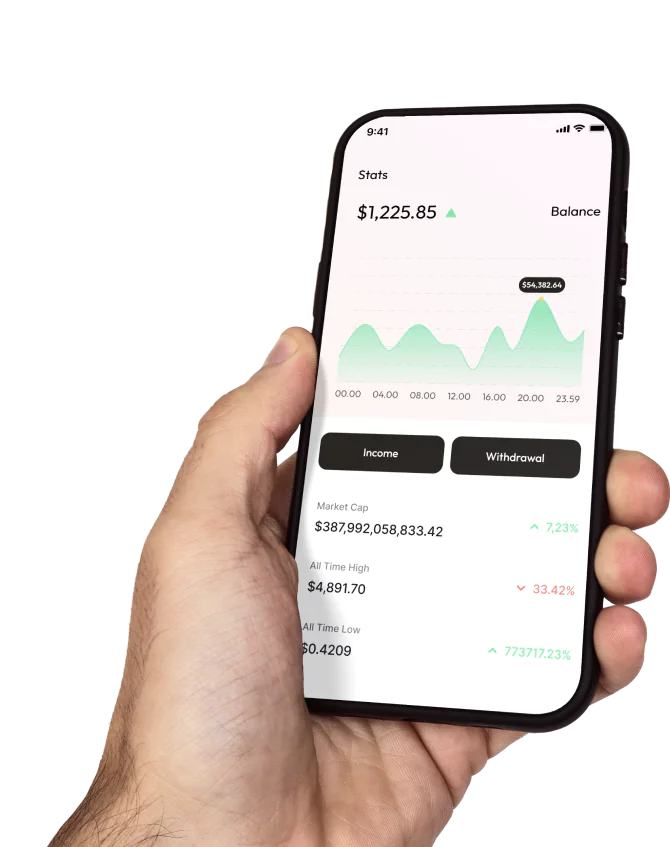

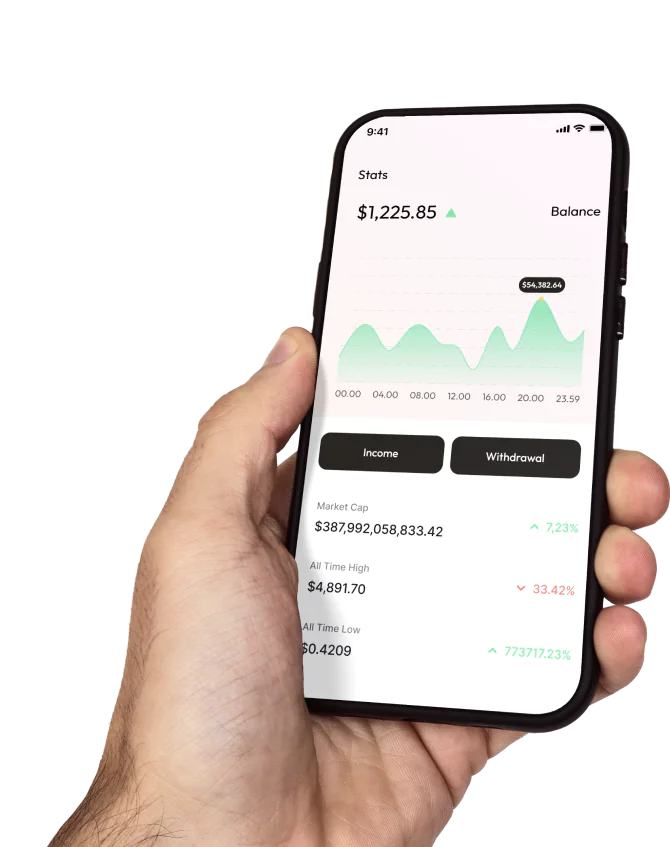

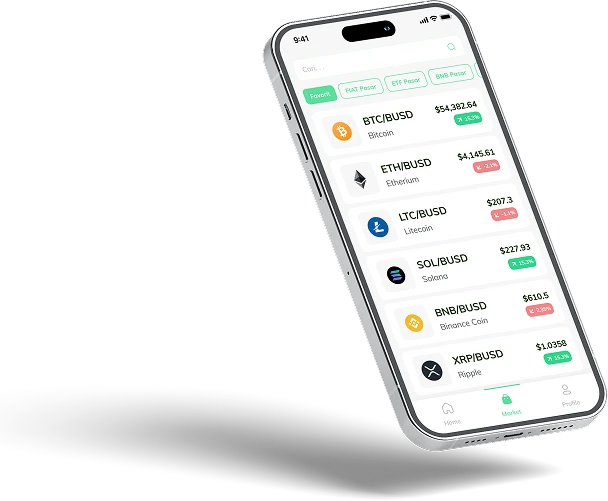

The interface is purpose built, showing intensity zones, movement rates, and participation strength so your attention naturally follows the market’s rhythm. Instead of reacting to fragmented information, you get structured insights tied to real shifts in momentum.

As the market compresses or volatility rises, Vital Advair identifies formations ahead of the crowd. Each signal carries context, strength, sequence, urgency, so you make choices grounded in observable structure, not speculation.

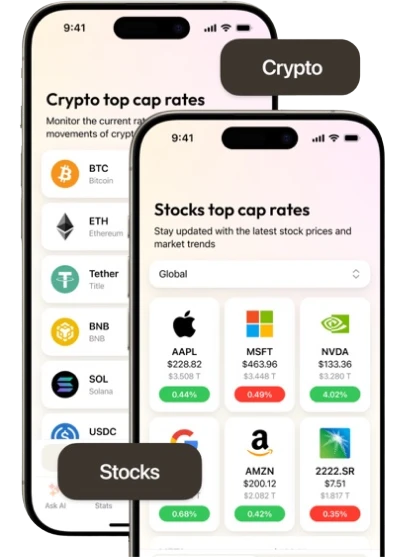

Markets move fast, and Vital Advair keeps pace. Sudden swings in cryptocurrency activity are captured immediately and translated into digestible insights. Forget repetitive charts, this system surfaces fresh directional signals by analyzing live transaction flows. With a responsive AI core, learning features, optional frameworks, continuous monitoring, a minimal interface, and layered security, Vital Advair gives you instant clarity in a volatile market. Loss is always possible, stay alert.

Watch the market like never before. Vital Advair tracks how momentum, liquidity, and trade rhythm evolve, showing you when a shift is brewing, what’s fueling it, and how far it might go. Forget reacting to random price ticks, focus on the movements that really matter, and turn complex data into clear, usable insight.

Vital Advair tracks changes in market dynamics by evaluating momentum shifts, behavioral trends, and group activity across multiple time frames—revealing early market turning points often missed by standard indicators.

Using time tested market methodologies, Vital Advair organizes strategies into clear, adaptable frameworks. Users can adjust, inspect, or halt any pathway as needed, maintaining full command at all times. No automatic actions are taken, and no trades are executed.

Through encrypted pathways and role specific authorization, Vital Advair safeguards confidential inputs. Data is segmented to avoid overlap, keeping user information fully isolated. Since no trades are executed, logs never intersect with transactional environments. All processes comply with stringent AI governance standards and are externally audited, without monitoring personal trading actions.

Vital Advair translates variations in market structure, signal strength, and trade flow into intuitive visual groupings. Fast paced activity is consolidated into digestible clusters, easing interpretation. Dynamic models adjust automatically based on triggers, producing outputs that reflect current conditions. Integrated learning modules and optional frameworks work seamlessly without compromising manual oversight. Warning: Digital asset trading carries inherent risk.

Vital Advair focuses on significant, recurring patterns instead of small, inconsequential movements. Early signals of pressure and momentum surges are captured and analyzed in the context of timing, environment, and flow. Sudden changes are presented clearly, keeping the interface clean. Continuous observation combined with a minimalist design ensures users stay focused on live market behavior, not stale indicators or redundant charts.

Transform complex market data into clear, actionable indicators. Vital Advair filters out the noise and surfaces only meaningful shifts, spotting where momentum fades, trends expand, and directional changes appear ahead of typical market reports.

Watch live trades unfold and let Vital Advair reveal early bias in the market. The system refreshes constantly, adapting to speed and volatility, highlighting breakout zones without relying on rigid templates. Your decisions stay manual, and strategy mirroring is optional.

Signals in Vital Advair undergo multiple stages of verification as conditions shift. Each finding is compared with ongoing market behavior to eliminate unreliable or misleading triggers. Only those confirmations that demonstrate repeatability and robust support are allowed through, ensuring insights reflect actual observable activity.

As price action evolves, Vital Advair synchronizes notifications with live market behavior, avoiding delayed reporting. Immediate recognition of developing trends gives users up to the moment insight, supporting decisions grounded in the now rather than retrospective analysis.

Designed for speed and simplicity, Vital Advair presents tools in a streamlined layout that keeps focus on clarity and reliable judgment. Continuous AI driven refinement and round the clock monitoring maintain precision and stability. Warning: Rapid market shifts in digital assets may result in financial loss.

Through visual modeling, directional references, and live force metrics, Vital Advair creates clearly defined planning zones. Users rely on verified readings and anchored reference points for deliberate preparation, rather than chasing erratic price action. The platform never executes trades and operates independently of exchange systems.

Embedded adaptive filters reduce the need for constant manual review, automatically adjusting as market structures evolve. Learning based models track shifting conditions, easing transitions during volatile periods and supporting proactive, rather than reactive, decision making.

Protection is handled with layered authorization, continuous monitoring, and isolated processing gates, ensuring sensitive functions remain secure. This produces a streamlined analytical environment for thoughtful, structured evaluation in dynamic markets.

By combining motion measurements, expansion cues, regional mapping, and depth sensitive data, Vital Advair identifies zones of emerging directional force. Each notification is specific, focusing attention on actionable scenarios rather than generalized market chatter.

Trends are assessed in structured tiers, factoring in movement velocity, angle of direction, and prior trigger activity. When several pressure signals converge, the system minimizes unnecessary alerts, highlighting only consistently reliable formations.

Rather than waiting for complete reversals, Vital Advair monitors acceleration shifts and emerging structural cues. Alerts activate as soon as responsive patterns appear, ensuring strategies remain aligned with real time market conditions.

Vital Advair adapts to the tempo of your approach. Fast paced strategies rely on sensitive, frequent signals, while long term plans reference broader market structures. Each method is calibrated to fit the rhythm of the chosen style, avoiding one size fits all projections.

Organized analysis strengthens decision timing. By tracking changes in flow speed, compression patterns, and initial rotations, Vital Advair highlights potential activation points. Sudden gaps and pivotal regions are marked and prioritized based on consistency and relevance, guiding measured responses instead of hasty moves.

Multiple potential outcomes are evaluated in parallel within Vital Advair, linking likelihood of direction with actionable planning strategies. Considering formation quality and historical market reactions, users build steadier decision making patterns. All analytical insights are recorded automatically, supporting better preparation and organized risk handling over time.

Using combined layers of directional structure, momentum depth, and force alignment, Vital Advair builds customized visual landscapes that reveal key convergence points where expansion or response phases are likely to emerge. Users can quickly recognize zones ready for attention.

The design highlights deceleration and early rotational signals. Velocity measurements pinpoint slowing activity, while curvature tracking detects gradual directional shifts. When critical signals meet planning thresholds, the interface communicates clear context, indicating observation, preparation, or review, without ever executing trades or connecting to exchanges.

Accuracy is preserved through filtering of insignificant movements and refined, time sensitive markers. Adaptive learning models monitor changes in rhythm and instantly adjust logic. By prioritizing verified signals and validating outputs rigorously, Vital Advair supports planning based on authentic market behavior rather than noise.

Using live signals from public engagement, activity patterns, discussion speed, headline frequency, and trend emergence, Vital Advair converts behavioral data into actionable market insights. All readings are validated against live market reactions, helping users make decisions based on confirmed movements rather than exaggerated narratives.

Rapid sentiment changes, sudden emotional bursts, and participation spikes are evaluated across diverse sources. Early recognition of irregular shifts, sentiment gaps, or fast reversals enables measured responses guided by awareness rather than emotion, reducing chain reactions and promoting steadiness.

Behavioral metrics are synchronized with live pricing to define influence regions where crowd behavior intersects with valuation trends. Misalignment between sentiment and price triggers alert layers, highlighting unreliable conditions before they affect judgment. As always, the system executes no trades and operates entirely separate from trading venues.

Vital Advair connects worldwide economic shifts, policy decisions, and regulatory changes directly to market behavior. Each event is evaluated for both scale and timing, separating impactful drivers from short term noise. This approach helps users see the difference between enduring market trends and temporary reactions.

Using layered analysis, major news is ranked for influence. By aligning price responses with precise information timing and historical outcomes, Vital Advair identifies patterns that repeat and signals that quickly fade.

Vital Advair combines structured frameworks with adaptive AI intelligence to deliver a clear view of market dynamics. By detecting deviations from expected price levels and recurring participation patterns, it identifies pressure zones often missed by conventional charts.

As fresh data streams in, the system recalibrates instantly, analyzing sequences of movement instead of isolated swings. The interface remains clean and focused, while optional replication tools let users simulate setups without relinquishing control over execution.

When larger market forces start to shift, Vital Advair compares current activity with long term rhythm references. This produces flexible planning frameworks that guide users away from impulsive reactions during sudden volatility. Decisions are driven by contextual understanding rather than surprise movements.

Pressure can pivot rapidly, and Vital Advair identifies these early by tracking stress concentrations and projecting potential movement paths. Alerts trigger immediately, yet all actions remain fully manual. Strength and directional bias are continuously updated with each new observation.

Within Vital Advair, learning based models identify initial compression areas that often precede breakout activity. Weak points and developing regions are highlighted early, offering actionable insight during the buildup phase before large scale moves occur.

Vital Advair structures fast moving and erratic price activity into clear, layered views. Behavioral signals, risk thresholds, and directional summaries are presented in a way that minimizes emotional reactions and supports deliberate execution. Note: Cryptocurrency markets are volatile, and financial losses may occur.

Blending automated analytics with seasoned market understanding, Vital Advair deciphers complex price dynamics, surfaces transaction flow stress, and pinpoints key inflection zones. By monitoring sentiment, participation changes, and pressure imbalances, it delivers steady directional guidance while remaining fully independent from trading activity.

A constantly updating intelligence core recalibrates with changing conditions, preserving interpretive consistency amid rapid expansions or reversals. In volatile digital asset markets, Vital Advair emphasizes structured evaluation and disciplined focus to help users manage exposure responsibly.

Vital Advair is built for everyone, from beginners to experienced traders. Guided introductions, ready to use views, and intuitive tools reduce complexity, helping newcomers interact comfortably without prior market experience.

The platform organizes signals into clear groups that reflect near term trends, behavioral structure, and market sentiment. Each signal is labeled by category and confidence, enabling users to quickly identify stable areas, watch zones, and rapidly forming opportunities with continuous updates.

Yes. The dashboard is fully adaptable to fit each user’s workflow. Layouts, filters, and focus components can be adjusted, ensuring the most relevant information remains front and center, whether monitoring a single asset or multiple scenarios.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |